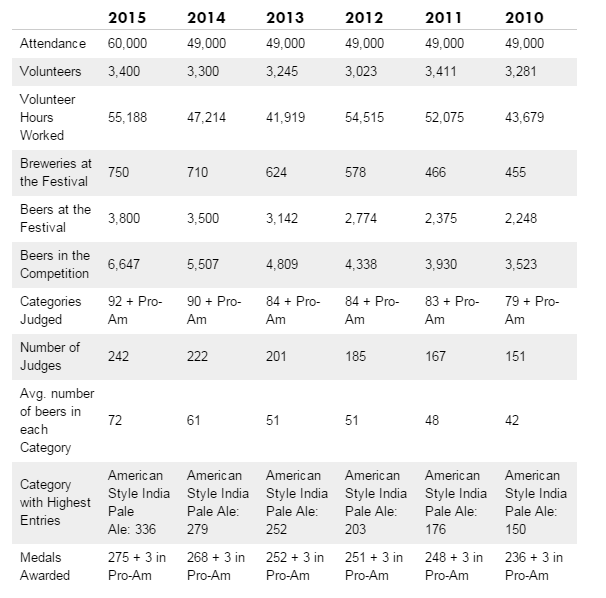

This first post in Brewin.Beer is something I’ve been musing about for a while. We all know that beers have become hoppier over the past few decades. Indeed, there was a time when Sierra Nevada Pale Ale was considered far too eccentric and hop-forward for the typical beer drinker. Nevertheless, we’ve seen their Torpedo become one of the most popular IPAs in the country; a de facto flagship brew. Similarly, we’ve seen Sam Adams Boston Lager, the most popular craft beer in the nation, lose tap space to up-and-coming smaller brewers, and its very own Rebel IPA. In this post, we intend to look at this data scientifically, diving deep into the various chemical characteristics of the hops, and how our demand for certain flavors in our IPAs is changing the $350 million US hop growing industry. What is driving this is a seemingly insatiable appetite for American hops. When reviewing the Great American Beer Festival statistics, we see that IPA continues to be the category with the most submissions.

What’s important to start with is a basic understanding of what a hop is. As a flowering plant, it is arguably the most important ingredient to create a beer’s flavor when used in styles such as IPA or pale ale. The cones of each hop contain a certain amount of oil; the content of which varies from strain to strain. When you boil a hop, the essential oils and alpha acids are released in the isomerization process, imparting the bittering and flavoring aspects to a given beer. Dry-hopping uses the solvent properties of the present alcohol to strip the essential oils from the hops, while not imparting any perceived bitterness. New brewing techniques such as hop bursting have provided beer drinkers with even more hop flavor and aroma, thus underscoring the need for brewers to focus on getting these aspects of their brewing right.

Hops have four basic essential oils: myrcene, carophyllene, farnesene, and humulene. Myrcene is a distinctive essential oil which imparts a large amount of citrus characteristics to foods, while carophyllene and humulene are regarded as “floral” or “spicy”. Those familiar with hops can pick out the “floral” or “spicy” flavors/aromas from mainly traditional beers produced in the U.K. or Continental Europe, while the most popular American IPAs tend to have a citrus-forward characteristic. Consequently, as our palate has changed, so has the demand for hops which boast larger percentages of these citrus-forward compounds.

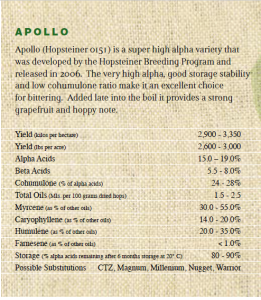

We looked at the hop harvests from 2000-2015, and broke down the percentage of each hop’s total oil quantity per USDA specifications. An example is that 100 pounds of hops with 2% oil would result in 2 pounds of essential oil. Now, we could have broken

this down into volume of hop oil, but our assumption is that all hop oils have roughly the same density, so we kept the measurement at weight instead of volume. We then used this “oil quantity” as a baseline for how much of each type of essential oil we’re working with. Because the USDA sets guidelines on how much of an essential oil a particular hop should have, we can use this data as a standard set of rules for our gathering of historical statistics on the yield of essential oils per year during every hop harvest. An example (left) of the 2013 USAHops guide illustrates these stats.

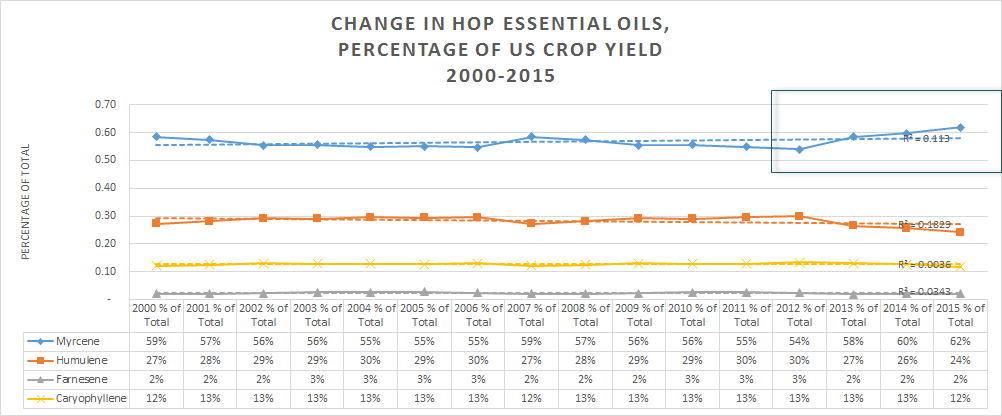

Given this primer, we can look at ask a question: have hops laden with myrcene surged in demand, thanks to the citrus-forward IPA craze in the United States?

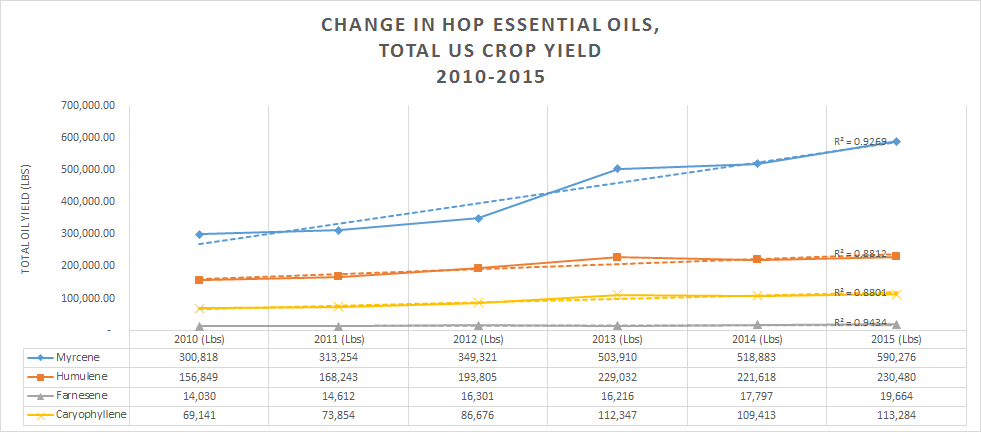

We can see in this chart a breakout trend of myrcene as a percentage of all harvested hop essential oils. A recent 14% (6 percentage point) surge since 2012 has propelled citrus-forward myrcene to dominate the hop industry. Citrus-flavors comprise almost two-thirds of all hops harvested. This is even more clearly pronounced if we focus on the last five years, looking at total pounds of hop essential oils.

What does this data mean? As the craft beer market–particularly the IPA and related styles–continues to evolve, it will be interesting to see if adoption of styles like IPA continue their meteoric rise. As newer types of styles emerge, such as sours, it could possibly convert existing IPA drinkers to more diverse flavors. Along the same lines, adoption of more assertive styles like pale ale and IPA could continue from American premium lager drinkers who are searching for more assertive, bitter, aromatic styles.

Thanks for reading! Please comment with any thoughts on how we can approach this with better science, or more accessible writing.